Since it is back to school season, today's visualization decomposes the market of muni obligors offering bonds in the Education Sector.

Since it is back to school season, today's visualization decomposes the market of muni obligors offering bonds in the Education Sector.

The Education Sector is one of the top two sectors in terms of number of obligors offering bonds and also holdings of CUSIPs by institutional investors. The other being General Obligation bonds for towns, cities and counties.

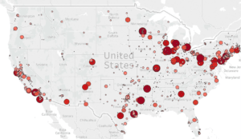

In this visualization we quantify where the obligors are located in the U.S. and how many Primary and Secondary vs Higher Eduction obligors are on the market. We also visualize the velocity of negative material changes happening in each obligor. The category Other tends to be composed by entities like a Board of Education.

(Download the Muni Education Sector Visualization)

Bitvore's AI surveils every obligor active in the municipal bond market. In the process of it's operation, the AI converts the alternative investment information of news, blogs and filings into quantified and refined information which is provided to Bitvore customers as Bitvore Alerts and The Muni Daily Brief. By analyzing the frequency in which negative material changes are detected about obligors we summarize the obligors that are most frequently generating negative warning signs in the first half of 2017. These warning signs represent counts of unique reports of activity that could indicate increasing risk in the asset. Together these counts over time provide a new measure of the velocity and volatility in the material changes of an obligor.

Download US Municipal Bond Obligors in the Education Sector.