Growth in ESG Adoption by the Investment Community

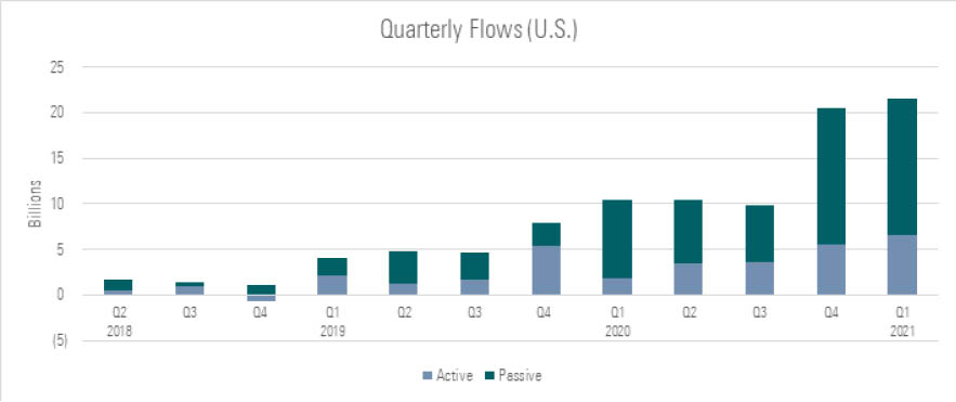

ESG adoption among investors continues to accelerate. In the U.S. alone, Morningstar reported that sustainable fund flows were at a record high during the first quarter of 2021 with approximately $21.5 billion in net flows, which is almost double the $10.4 billion in the first quarter of 2020 and nearly 5 times the amount in the first quarter of 2019. Additionally, a recent Natixis investors survey showed that 77% said ESG factor analysis is integral to sound investing and 48% said those factors are important to fundamental analysis.

What Companies Say vs What They Actually Do

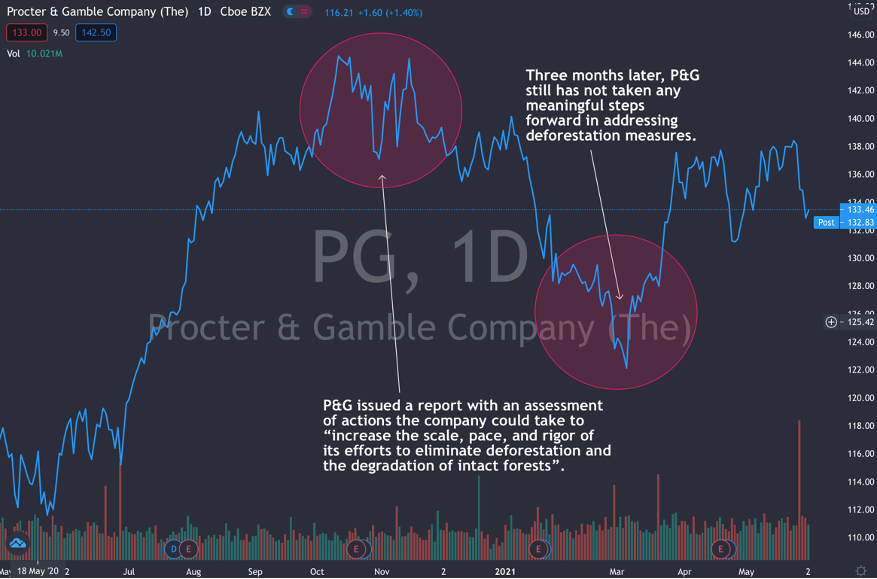

In the past, companies often committed to sustainable goals to appease shareholders. However, this “greenwashing” without follow-through has become unacceptable to market participants and corporate inaction often has a profound effect on their stock price. A recent example is P&G. In October of 2020, P&G’s shareholders raised frustration at the company’s actions in addressing deforestation measures. As a result, shareholders, led by Green Century Equity Fund, passed demands by two-thirds to eliminate deforestation and intact forest degradation from its supply chain. Events leading up to the October vote were met with resistance by P&G who publicly opposed such preventative measures.

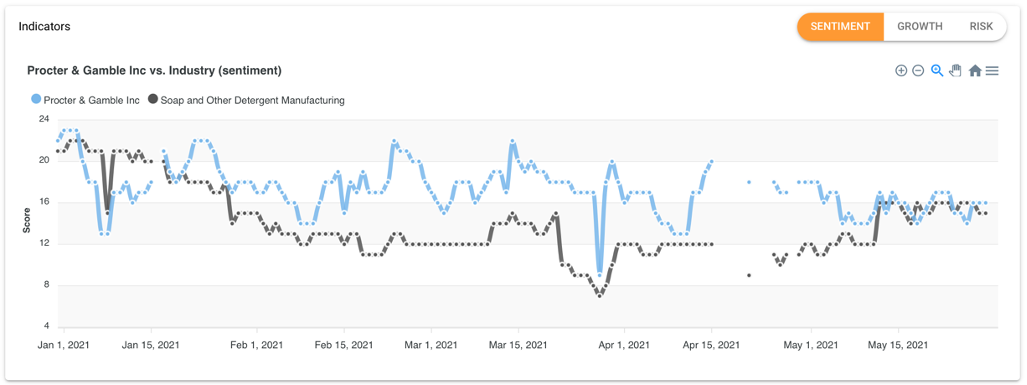

After the vote, P&G agreed to the demands in an emailed response from its media relations office, noting that as a result of the shareholder vote it would include an issued report with an assessment of actions the company could take to “increase the scale, pace, and rigor of its efforts to eliminate deforestation and the degradation of intact forests” (source). Fast forward to February 2021, P&G still has not taken any meaningful steps forward in addressing deforestation measures. In the graph of Bitvore’s ESG sentiment data in Figure 1 below, you can see sentiment in P&G trailing its industry in Q1 2021, which would have been a good leading indicator of where the stock was headed. The company’s declining stock performance was a direct indication of investor sentiment.

Figure 1 – Bitvore ESG Sentiment Data for P&G Shows Them Trailing the Industry Prior to Declining Stock Price

Gone are the days where companies can simply document sustainable goals without taking meaningful action. Figure 2 below is the historical stock chart of P&G showing the stock price selling off and breaking below the support level of the initial October 2020 resolution measures.

Figure 2 – Declining P&G Stock Price Related to ESG Issues

Regulatory Support in ESG Reporting

As investors focus more on ESG, the demand for tools to track ESG developments is also rising. Most companies self-report goals and actions/results periodically, but these reports are delayed and make it hard to distinguish between greenwashing and real action. To help provide transparency, new regulations such as the EU’s Sustainable Finance Disclosure Regulation (SFDR) seem promising. The SFDR aims to help investors gain access to the disclosures necessary to make decisions in line with their sustainable investing goals.

The Need for Timely Data

While regulatory changes are a good path forward, investors still need timely data to make informed decisions. The markets are ever-changing and alpha generation is becoming more difficult without the data to get a 360-degree view of investable assets. Investors are no longer willing to wait for the next company filing; they want actionable insights at their fingertips.