Texas continues to attract cryptocurrency miners with inexpensive power and few regulatory hurdles. Electricity demand in Texas hitting record levels amid critically high temperatures this summer but the state continues to be a prime destination for cryptocurrency mining companies hungry for electricity.

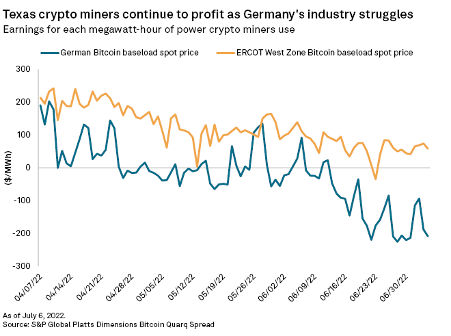

Data demonstrates the fluctuations in profitability for miners and how it can differ from one market to the next. In some European countries where energy costs are high, bitcoin mining is no longer profitable, according to data from S&P Global Commodity Insights' Platts Bitcoin Quarq platform. On July 6, for example, German miners were losing $186 for each MWh of electricity they used to mine cryptocurrencies. In contrast, miners in West Texas made $64 for each MWh used that day, the data shows.

Interest in mining activity in Texas is high and growing. Mining companies use powerful computers housed in sprawling data centers to verify, process and record cryptocurrency transactions. A single bitcoin transaction requires 1,695 kWh of electricity, about what an average U.S. household uses in 58 days, according to Digiconomist, a platform managed by Dutch economist and blockchain expert Alex de Vries. That same transaction produces 805 kilograms of carbon dioxide, de Vries' research shows.

Texas has used incentives such as generous demand response programs for large industrial and commercial customers to lure cryptocurrency miners to Texas. So far, about 10 mining facilities have connected to the grid, ERCOT said. Some commentators are suggesting the state maybe is getting in over its head with worries cited that the more they soak up low-cost electricity and electricity in peak hours that the rest of “normal” users need.

Meanwhile, other efforts are afoot that could rein in the cryptocurrency sector in different ways.

In New York state, lawmakers have imposed a two-year moratorium on any cryptocurrency mining operations that use the energy-intensive "proof of work" process to verify transactions of digital coins, saying the industry is jeopardizing the state's greenhouse gas reduction goals. The state is also going after companies that use fossil fuel plants to mine cryptocurrencies.

And European Union regulators recently hammered out a deal to regulate firms that trade cryptocurrencies — a move that some believe will make it harder for investors to make money.

If so, mining companies in Texas do not yet seem to feel the pain. Large cryptocurrency mining companies seem intent on weathering the price crash and, if anything, Texas may only look more attractive to miners than it did a few months ago.

Back in February 2021, Texas suffered a massive storm resulting in a complete loss of power for many parts of the state. The storm highlighted the fragile nature of the Texas power grid. Despite this fragility, Texas continues to lure cryptocurrency miners with inexpensive power and few regulatory hurdles. Electricity demand in Texas hitting record levels amid critically high temperatures this summer but the state continues to be a prime destination for cryptocurrency mining companies hungry for electricity.

Are you tracking the digital asset market and trying to stay up to date with cryptocurrencies, NFTs and blockchain?

Stay up-to-date on the latest developments in the fast-changing digital asset space with our free AI-augmented Digital Asset daily alerts service.

Our ground-breaking AI-powered platform ingests massive amounts of unstructured data and uses advanced NLP and machine learning to provide unprecedented insights. We track performance and developments in the global crypto market, NFTs and blockchain with sentiment scoring for every update.

Trusted by more than 70 of the world’s top financial institutions, Bitvore provides the precision intelligence capabilities top firms need to counter risks and explore opportunities with power of data-driven decision making.

Uncover rich streams of ESG and risk insights from unstructured data that act as the perfect complement to the internal data and insights your firm is already generating. Our artificial intelligence and machine learning powered system provides the ability to see further, respond faster, and capitalize more effectively.

Get in touch today to learn how the Bitvore family of products can help your organization at www.bitvore.com.