The Justice Department and six states are suing American and JetBlue to break up their partnership in the Northeast, namely New York and Boston. This case will be a significant test of the administration’s opposition to mergers, even though the American-JetBlue partnership is not a full merger. The government argues that the alliance will reduce competition and lead to higher fares.

American and JetBlue will argue there is no evidence that the deal is hurting consumers. The partnership has already been in effect for about 18 months and, it will no doubt be cited, has allowed each airline to offer new routes that would not be economical for either on its own.

U.S. District Court Judge Leo Sorokin has set aside nearly three weeks for the trial. A decision will take weeks or even months to be issued with an appeal likely by the losing side.

The Justice Department’s top antitrust official, Assistant Attorney General Jonathan Kanter, said “We remain committed to fighting airline concentration when it breaks the law. We are looking very carefully at our approach to airline consolidation ... we have numerous other matters under review.” Kanter didn’t say what those other matters are, but one likely could be JetBlue’s proposal to buy Spirit for $3.8 billion.

The government says that together, American and JetBlue will control more than 50% of the market (sometimes more than 80%) on routes from New York and Boston where they previously competed head-to-head.

The Justice Department seems to be expressing buyer’s remorse about many previous airline mergers that went largely unchallenged. Those deals eliminated Continental, Northwest, US Airways, AirTran, TWA and other airlines, and they led to the downgrading of once-bustling hub airports including St. Louis, Cleveland and Pittsburgh. Consumer advocates say those mergers have led to higher prices and lower service, particularly from the four biggest airlines: American, Delta, United and Southwest.

The first day of the trial veered into JetBlue's plan to buy low-cost rival Spirit, when Justice Department attorney John Davis repeatedly pressed on whether competition with Spirit forced JetBlue to offer lower prices. JetBlue Chief Executive Robin Hayes defended the acquisition from the witness stand, saying it would create "one of the most powerful, disruptive forces that this country has seen."

American Airlines is the world's largest airline by fleet size with over 1,300 aircraft units in its mainline. It has more than 120,000 employees and operates almost 6,700 flights daily to roughly 350 destinations in over 50 countries.

This court case follows American Airlines’ recent bad press due to a phishing attack involved unauthorized access to Microsoft 365. The airline said in filings with the Office of the New Hampshire Attorney General, after receiving phishing reports, American's CIRT discovered unauthorized activity in the company's Microsoft 365 environment. The data breach impacted 1,708 American Airlines customers and team members.

The investigation also revealed the attacker accessed multiple employees' accounts (also compromised via phishing attacks) and used them to send more phishing emails to targets American Airlines has not yet disclosed. The company added that the team members' accounts also provided access to employee files stored on the SharePoint cloud-based service.

"Through its investigation, American was able to determine that the unauthorized actor used an IMAP protocol to access the mailboxes. Use of this protocol may have enabled the unauthorized actor to sync the contents of the mailboxes to another device," a legal notice describing the security incident explains.

The airline was hit by another data breach in March 2021 when global air information tech giant SITA said hackers breached its servers and gained access to the Passenger Service System (PSS) used by multiple airlines worldwide, including American Airlines.

Trusted by more than 70 of the world’s top financial institutions, Bitvore provides the precision intelligence capabilities top firms need to counter risks and drive efficiencies with power of data-driven decision making.

Our clients uncover rich streams of risk and ESG insights from unstructured data that act as the perfect complement to the internal data and insights your firm is already generating. Our artificial intelligence and machine learning powered system provides the ability to see further, respond faster, and capitalize more effectively.

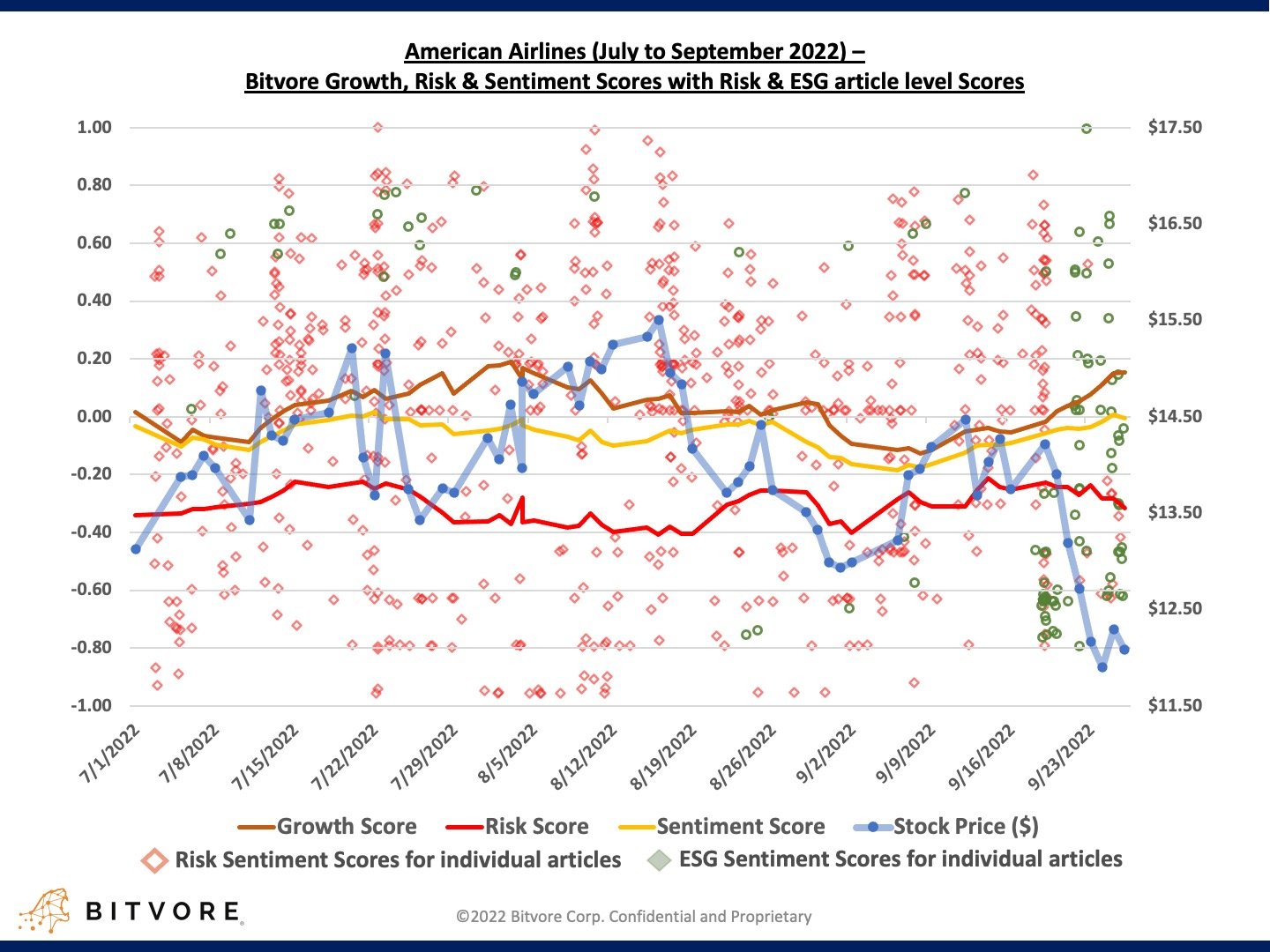

The following diagram is a snapshot of some of the recent risk and ESG insights we’ve uncovered about America Airlines since July:

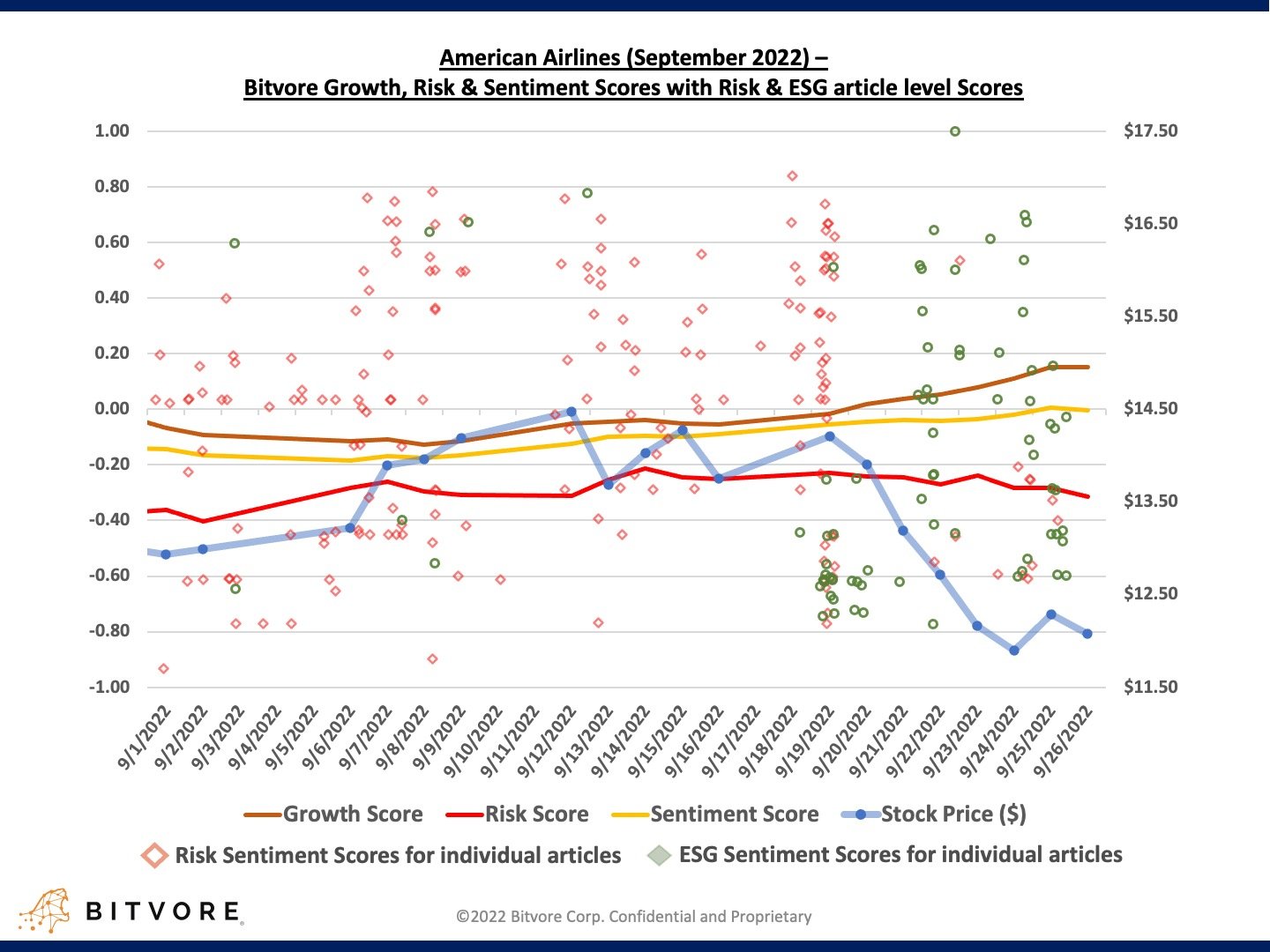

Drilling down into September’s risk and ESG insights a significant increase in ESG related insights and content started around the 18th of the month, and remain prevalent. The green diamonds on the chart indicate the recent cluster of ESG related events:

More forward-thinking investors are increasingly building out their own ESG and Sustainability research, analysis and risk control functions to dive deeper into the types of insights our processes uncover. Get in touch today to learn how the Bitvore solutions can help your organization at www.bitvore.com.