On Monday, in an uncharacteristic move, Ford Motor Executive Chair Bill Ford warned that the ongoing strike by the United Auto Workers (UAW) threatens the future livelihood of the company as well as the American automotive industry.

Ford pleaded with union members and leaders to work with the company, instead of against it, to reach a tentative deal to “end to this acrimonious round of talks.” “We are at a crossroads, choosing the right path is not just about Ford’s future and our ability to compete. This is about the future of the American automobile industry. The UAW’s leaders have called us the enemy in these negotiations. But I will never consider our employees as enemies. This should not be Ford versus the UAW,” Ford said. “It should be Ford and the UAW vs Toyota and Honda, Tesla, and all the Chinese companies that want to enter our home.”

UAW President Shawn Fain countered Ford. “Bill Ford knows exactly how to settle this strike. Instead of threatening to close the Rouge, he should call up Jim Farley (Ford’s CEO), tell him to stop playing games and get a deal done, or we’ll close the Rouge for him,” he said in a statement. “It’s not the UAW and Ford against foreign automakers. It’s autoworkers everywhere against corporate greed. If Ford wants to be the all-American auto company, they can pay all-American wages and benefits. Workers at Tesla, Toyota, Honda, and others are not the enemy — they’re the UAW members of the future.”

Over 19,000 of Ford’s 57,000 UAW members are currently impacted by the strike, including the circa 16,600 striking workers. Another roughly 2,500 employees have been laid off as a result of the work stoppage.

Ford last week said it was “at the limit” of what it can offer the UAW in terms of economic concessions. The company’s most recent proposal included 23% to 26% wage increases depending on classification; retention of platinum health-care benefits; ratification bonuses; reinstatement of cost-of-living adjustments; and other benefits. Ford said on Friday that employees who have been on strike since Sept. 15 have on average lost about $4,000 in pretax income through four weeks of the strike.

Strike Approach Changes

Fain last week said the union has entered a “new phase” of the targeted strikes in which it would no longer pre-announce the work stoppages, as it had been. Fain has said it’s ultimately up to the members to decide when the strike ends, not UAW leadership. The UAW is no longer notifying the Big Three automakers before calling additional walkouts amid the labor group's ongoing strike, Fain said in a live webcast on Friday. "We are prepared at any time to call on more locals to stand up and walk out," Fain said. "Going forward, we will be calling out plants when we need to, with little notice."

On Tuesday, Stellantis NV said it's cancelling its plans for a display and presentation at the CES technology expo in January in Las Vegas, citing the costs of the United Auto Workers' strike. Stellantis in a news release said the move to skip CES is about "preserving business fundamentals" as it executes "comprehensive countermeasures to mitigate financial impacts and preserve capital."

Next week, GM and Ford will release their third-quarter earnings, which will include indications of how the strike has affected them so far. Stellantis will release its shipments and revenues on Oct. 31.

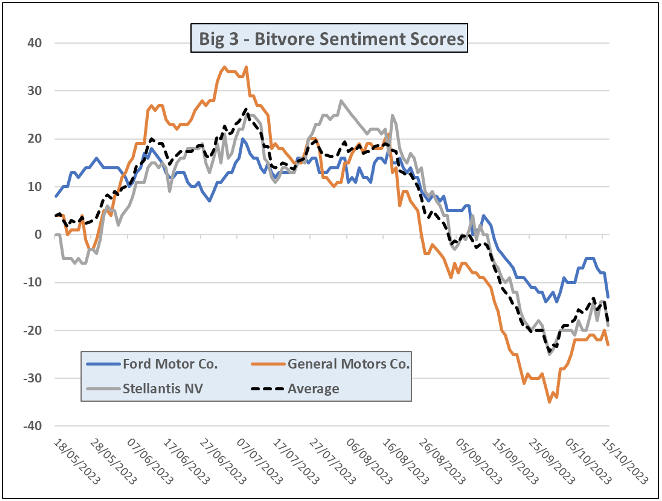

Below we have plotted the last 5 five months Bitvore Sentiment scores for Ford, Stellantis and GM.

Four weeks of a UAW strike have already created $7.7 billion in industry losses, according to Michigan consulting firm Anderson Economic Group (AEG). That includes $3.45 billion in losses for the Big Three, the firm estimates.

The ripple effects from the UAW's strike continue to spread further through the auto sector, hampering the industry, and threatening to put some suppliers out of business completely. The United Auto Workers strike is potentially nearing the "danger zone" as idle production lines cease building vehicles, the smaller firms that contribute to the supply chain could be on the chopping block.

Small Suppliers at Risk

One of the darker omens for the auto industry is now that the length of the UAW strike has entered its second month, some of the smaller companies that contribute to the assembly plants that build the vehicles could go out of business. The manufacturers that make plastic and metal parts for Ford, General Motors, and Stellantis vehicles now risk running out of money.

Professor Marick Masters of Wayne State University said. "They are not necessarily ‘mom-and-pop,’ but they’re small businesses. They may have 10 to 20 employees, 30 employees or less. And they don’t generate a whole lot of revenue on an annual basis, but they generate enough to sustain that number of workers and provide good living wages for people."

AEG have said supplier wages and earnings are down nearly $2.67 billion. Patrick Anderson of the AEG warns that some vehicle models may have hit the "point of no return." "Right now, if we don’t get to work right away. I do think there will be entire production lines on the chopping block," he said. "For Michigan in particular we’ve already had a lot of damage done," Anderson said. "But we’re in the danger zone in terms of being able to sustain all the investments that we have, and all the businesses that we have now."

Miss Nothing With Bitvore's Automated Intelligence

Trusted by more than 70 of the world’s top financial institutions, Bitvore provides the precision intelligence capabilities top firms need to counter risks and drive efficiencies with power of data-driven decision making.

Uncover rich streams of risk and ESG insights from unstructured data that act as the perfect complement to the internal data and insights your firm is already generating. Our artificial intelligence and machine learning powered system provides the ability to see further, respond faster, and capitalize more effectively.

To learn how the Bitvore solutions can help your organization contact info@bitvore.com or visit www.bitvore.com