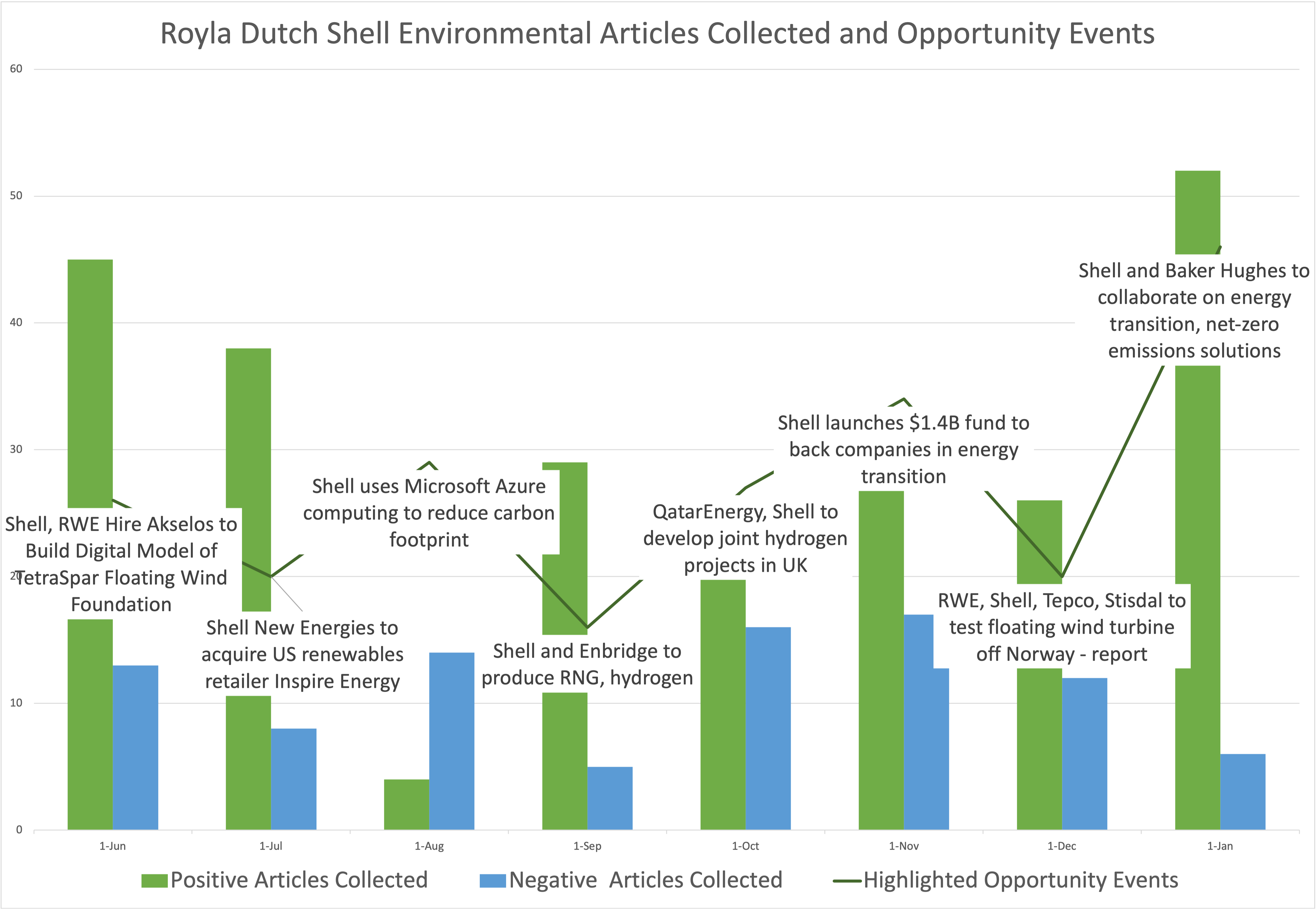

With rapidly evolving regulations globally, as well as consistent demands for more transparency, it is more essential than ever to keep tabs on corporate sustainability practices. Bitvore’s Corporate ESG tool provides a holistic and comprehensive picture of corporate behavior by turning unstructured data and using AI to pinpoint opportunities and risks within a sector. Our case study aims to demonstrate this by using Shell as a representative for the energy and gas sector. Through our data’s insights, we’ll explore the opportunities, such as Shells’ shifts towards sustainability, while also highlighting the hidden risks that can arise when investing in a major fossil fuel company.

Many energy companies are seizing opportunities to collaborate with their sustainable counterparts as they strive toward eco-friendly operations or net-zero emission goals. Shell has been seizing partnership opportunities across the globe as the energy giant strives to reduce their carbon footprint. One of Shell’s European arms, Shell Chemicals Europe B.V., has allied with chemical recycling company Pryme B.V. to construct a new facility “forecasted to convert 60,000 tonnes of plastic waste into pyrolysis oil annually.” Pyrolysis oil, a substitute for petroleum, may prove to be a more sustainable alternative to ethane and other natural gases, providing an opportunity for recycling of plastic waste into profitable materials at an industrial level. Thomas Casparie, Shell Chemicals SVP of NW Europe, commented, “the agreement builds on Shell’s ambition to recycle one million tonnes of plastic waste per year in our global chemicals plants by 2025.” This project provides a sustainable solution for customer demand.

In Alberta, Shell Canada has turned its focus to solar, partnering with US based Silicon Ranch (minority-owned by Royal Dutch Shell) to build a 58-megawatt solar farm. The farm, adjacent to Shell’s refinery and chemicals park, endeavors to offset emissions from the plant by providing enough renewable electricity for 20% of the energy required by the refinery. Shell’s vision for the park is, “really material decarbonization, of either the existing products we produce through the refinery . . . or creating the opportunity for future production of things like hydrogen or biofuels as well.”

In lieu of partnerships, larger fuel companies are acquiring local retail chains to allow for more climate-friendly alternatives. Shell Oil Products US announced in October of 2021 the company’s plan to acquire 248 Timewise-brand fueling stations across Texas. “Shell said the deal would allow it to offer customers more EV charging, hydrogen, biofuels, and lower-carbon premium fuels, but it would do so ‘in step with society’ per its Powering Progress strategy. This acquisition also grows the company’s retail footprint in the US where it currently operates over 13,000 Shell-branded properties.

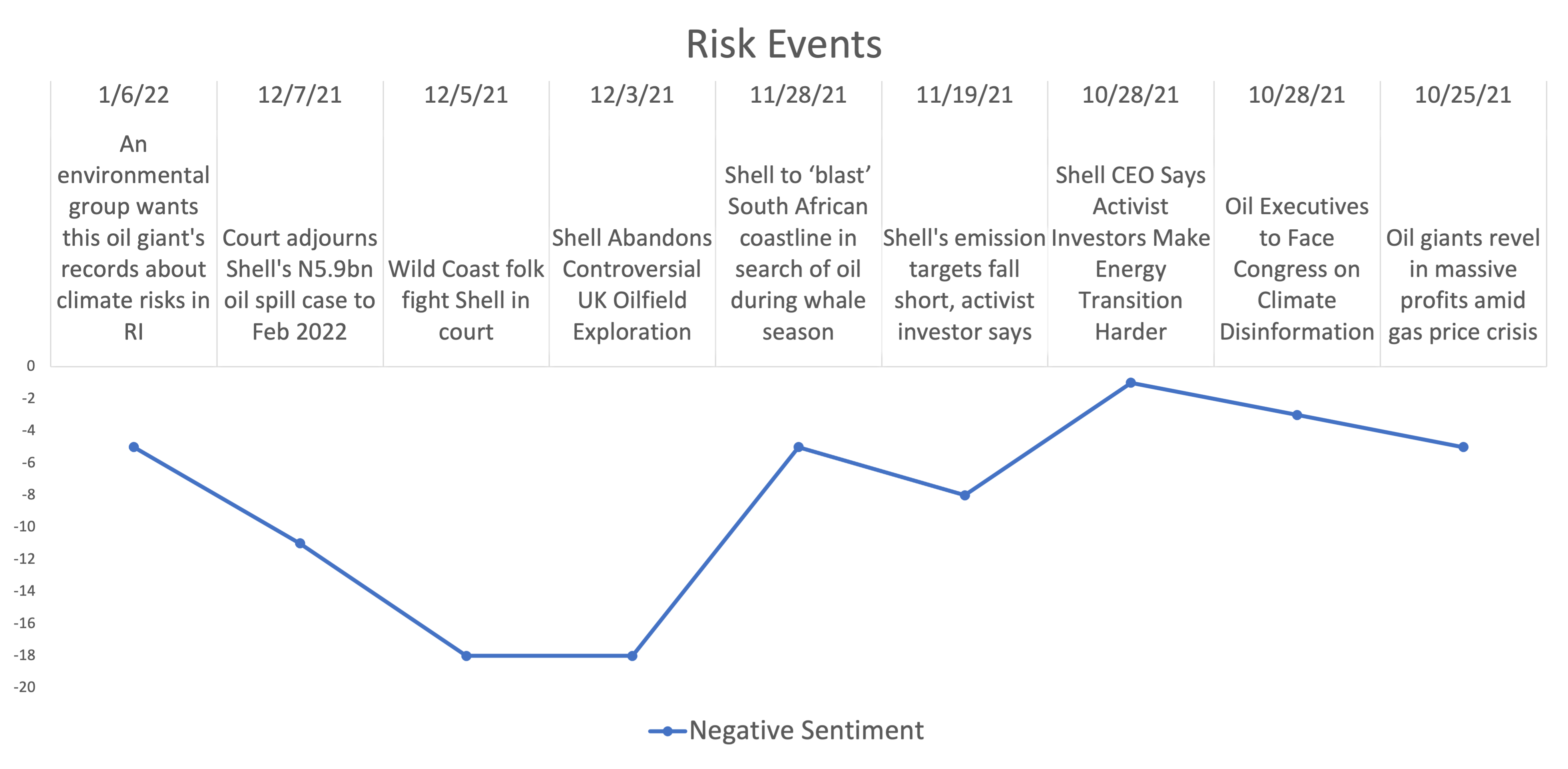

Despite efforts towards climate-friendly practices, we can see evidence of some reluctance to give-up traditional business models and resources. When asked about the future of the energy market, the CEO of BP is quoted saying, “It’s going to be natural gas, it’s going to be solar, it’s going to be wind, it’s going to be hydrogen, it’s going to be nuclear ... What a company like ours, not just ours, but a company like ours can do, it can knit together two different forms of energy to give customers what they want.” Currently, both renewable energy and fossil fuels are profitable to major energy companies. Combined revenue makes these corporations reluctant to transition solely to cleaner energy despite the environmental ramifications. “In its second quarter of 2021, Shell’s reported $5.53 billion in adjusted earnings the bulk of which came from oil and natural gas, $1.3 billion from refining, trading and marketing, and $670 million from chemicals.”

In the past, it has often been cited that these companies have made profit a priority over the environment, practicing non-disclosure in regard to their environmental impact. Moving forward, it’s important to be able to trust these companies’ actions. The one foot in and one foot out approach of sustainable energy and fossil fuels simultaneously has caused friction within the business models of large energy companies. As Shell continues to partner on sustainability projects, many investors fear their strategies across the board have become “incoherent” and confusing. Daniel Loeb, who runs the hedge fund Third Point, believes that competing pressures will immobilize the company’s growth. “Shell has too many competing stakeholders pushing it in too many different directions," the billionaire investor wrote to his clients in a letter, ”... Shell would benefit from a different structure that would let it cut costs and invest more aggressively in decarbonization,” he added. Loeb’s solution would be for Shell to spin-off into multiple companies, a restructuring plan that smaller competitors have undertaken. Loeb expands, “Shell's last two decades have been difficult for shareholders with annualized returns of just 3%. The company's American Depository Receipts rose 2.5% on the news of Third Point's involvement."

As we can see from the examples above, the transition for fossil fuel companies to sustainable resources is anything but easy. Shell’s journey displays the turbulence currently within the energy sector and how difficult it can be to move forward without a plan. Mounting pressures from investors, and the profitability importance of sustainable practices makes it crucial to track as companies continue to evolve. While the path isn’t straightforward, Bitvore’s corporate ESG tool helps investors to stay up-to-date on opportunities and risks as they unfold.