In our blog earlier this year, we highlighted that banks and investors were increasingly singling out US office commercial real estate as an area of growing concern, with property values falling and more borrowers defaulting on their loans amid rising interest rates and a slowing economy.

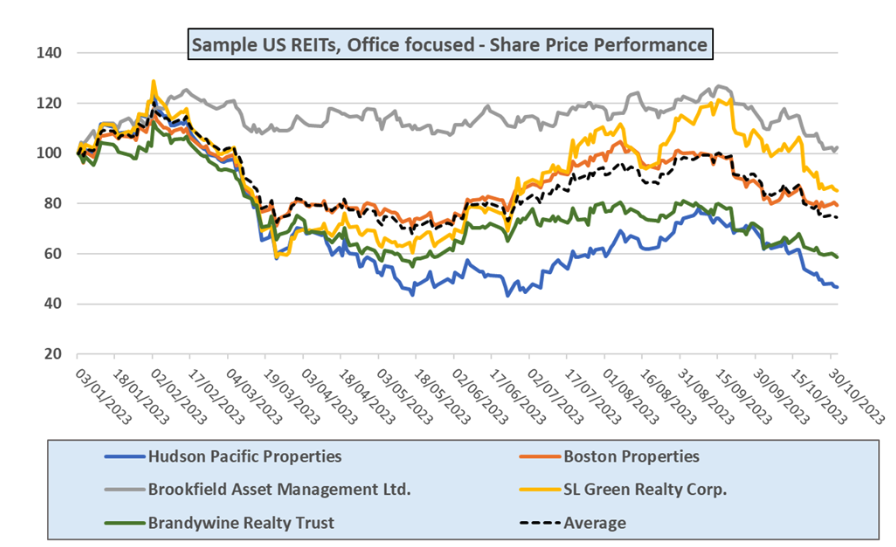

A number of listed entities exposed to US Office Real Estate have experienced significant share price volatility over the last 6 months.

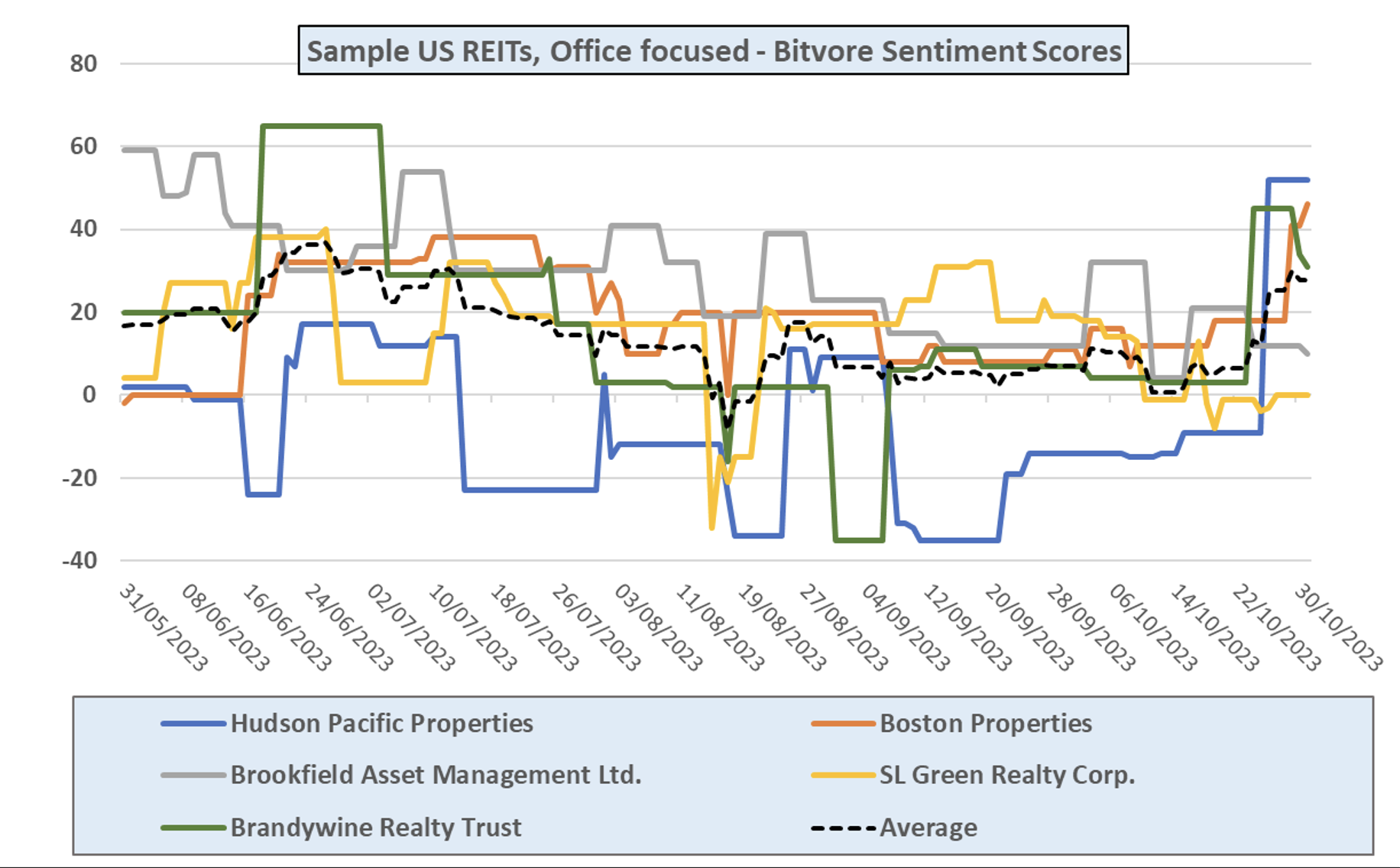

Over the last month or so we have seen a marked uplift in Bitvore’s Sentiment Scores for a number of these businesses.

With Sentiment improving and further interest rate rises potentially now unlikely the current valuations of listed entities exposed to US Office Real Estate may represent good relative value. With the US Federal Reserve and the Bank of England both citing that a recession can be avoided in their respective countries. The hope is that the central banks will steer their respective economies towards a "soft landing" by bringing down inflation without hurting the economy.

Investors though are no doubt watching with interest recent developments around the consequences of mandated returning to office. Three recent reports; the Greenhouse Candidate Experience report, the Federal Reserve’s Survey of Household Economics and Decisionmaking (SHED), and Unispace’s Returning for Good report paint a fascinating picture of potential issues ahead.

Unispace found that nearly half (42%) of companies with return-to-office mandates witnessed a higher level of employee attrition than they had anticipated. With almost a third (29%) of companies enforcing office returns are struggling with recruitment.

The Greenhouse report found over 75% of employees stand ready to jump ship if their companies decide to pull the plug on flexible work schedules. In the SHED survey, the gravity of this situation becomes more evident. The survey equates the displeasure of shifting from a flexible work model to a traditional one to that of experiencing a 2% to 3% pay cut.

Flexible work policies have emerged as the ultimate edge in talent acquisition and retention. The Greenhouse, SHED, and Unispace reports, when viewed together, provide compelling evidence to back this assertion.

Greenhouse finds that 42% of candidates would outright reject roles that lack flexibility. In turn, the SHED survey affirms that employees who work from home a few days a week greatly treasure the arrangement.

Interestingly, Unispace throws another factor into the mix: choice. According to its report, overall, the top feelings employees revealed they felt toward the office were happy (31%), motivated (30%), and excited (27%). However, all three of these feelings decrease for those with mandated office returns (27%, 26%, and 22%, respectively). In other words, staff members were more open to returning to the office if it was out of choice, rather than forced.

Miss Nothing With Bitvore's Automated Intelligence

Trusted by more than 70 of the world’s top financial institutions, Bitvore provides the precision intelligence capabilities top firms need to counter risks and drive efficiencies with power of data-driven decision making.

Uncover rich streams of risk and ESG insights from unstructured data that act as the perfect complement to the internal data and insights your firm is already generating. Our artificial intelligence and machine learning powered system provides the ability to see further, respond faster, and capitalize more effectively.

To learn how the Bitvore solutions can help your organization, contact info@bitvore.com or visit www.bitvore.com.