Banks and investors are increasingly singling out US office commercial real estate as an area of growing concern, with property values falling and more borrowers defaulting on their loans amid rising interest rates and a slowing economy.

During recent results calls analysts have been questioning banks about their exposure to commercial real estate and potential of losses, with executives at Wells Fargo & Co, Citigroup and JPMorgan Chase & Co saying conditions were getting worse for the sector.

"Weakness continues to develop in commercial real estate office," said Wells Fargo Chief Executive Charlie Scharf. The bank set aside an additional $643 million in the first quarter for credit losses, mainly driven by expectations of higher Commercial Real Estate loan losses. JPMorgan Chief Executive Jamie Dimon said he expected tighter lending conditions, most of it around “certain real estate things” and that “increases the odds of a recession.”

Stress in the commercial real estate sector could have broad implications for banks and the economy, tightening credit availability and potentially exacerbate a downturn. Banks represent over 50% of the overall $5.7 trillion commercial real estate market, with the small lenders holding 70% of commercial real estate loans with over $1.4 trillion of the loans maturing by 2027. In the short term it is estimated $270 billion of loans become due this year.

Loans backed by offices make up the biggest share of the maturing debt load, the question now facing many borrowers is whether they can refinance or restructure loans to avoid default. Office properties are currently facing the greatest refinancing risks as companies reassess their needs.

Concerns About Smaller Bank Exposure

Since March, when the abrupt and unexpected failure of two regional U.S. banks, Silicon Valley Bank and Signature Bank, rocked U.S. markets, investors have begun voicing concerns about the balance sheet vulnerabilities of regional bank and specifically, their exposure to commercial real estate.

JP Morgan estimate that compared to big banks, small banks hold 4.4 times more exposure to U.S. commercial real estate loans than their larger US based peers. Within small banks, these loans make up 28.7% of assets, compared with only 6.5% at big banks. A significant percentage of those loans will require refinancing in the coming years, exacerbating difficulties for borrowers in a rising rate environment.

With the widespread adoption of hybrid work patterns, such as remote working, post COVID-19 the negative headwinds for the office sector have been evident for some time. Rising rates are increase the pressure on the troubled office sector. Vacancies soared in the early stages of the pandemic and have kept rising since. Current US the office vacancy rates of 12.5% is comparable to where it was in 2010, one year after the global financial crisis with sales volume is now approaching post 2008 lows.

Data from Trepp highlights how potential issues are emerging by geography. For example, Chicago and San Francisco are much more challenged than Miami, Raleigh and Columbus. Their analysis also highlights that newer office builds, particularly those built after 2010, are seeing much stronger net absorption rates than older builds.

Inevitably, the tightening of credit availability and higher rates will spell trouble for some borrowers. Although the liquidation rate in the sector is low at present, it is likely take many years to play out.

If, in the months to come, the Federal Reserve raises rates even higher, some borrowers may struggle and could be unable or unwilling to provide additional capital to extend the life of their loans. However, given current market conditions, lenders are unlikely to repossess commercial properties that they would have to either manage or sell, especially at stressed valuations. Instead of foreclosing, lenders may find it prudent to offer borrowers short-term forbearance or modify loans.

Estimated as to how much the US commercial real estate market has fallen in the last year vary. According to the National Council of Real Estate Investment Fiduciaries, prices are currently down only about 5.5% in the last 12 months, but the Green Street Commercial Property Price Index has prices down 15%.

To assess the potential negative impact on earnings for banks, several factors will drive the outcome including the size of the banks’ exposure, the magnitude of their losses across vulnerable commercial real estate sectors and the severity and speed of any losses.

For a worst-case scenario, the Fed’s most recent industry-wide Dodd Frank Act stress test analysed the impact of a “severely adverse” market scenario would result in a 40% drop in aggregate commercial real estate prices. This test scenario is meant to represent an extremely bearish outcome for the U.S. economy. Current Industry commentator’s bearish predictions are in the range of a 10% to 20% fall, with some segments getting hit 1.5X to 2X harder. Other’s remain long term bullish, mainly based on predictions of Fed easing in Q4/Q1 2024.

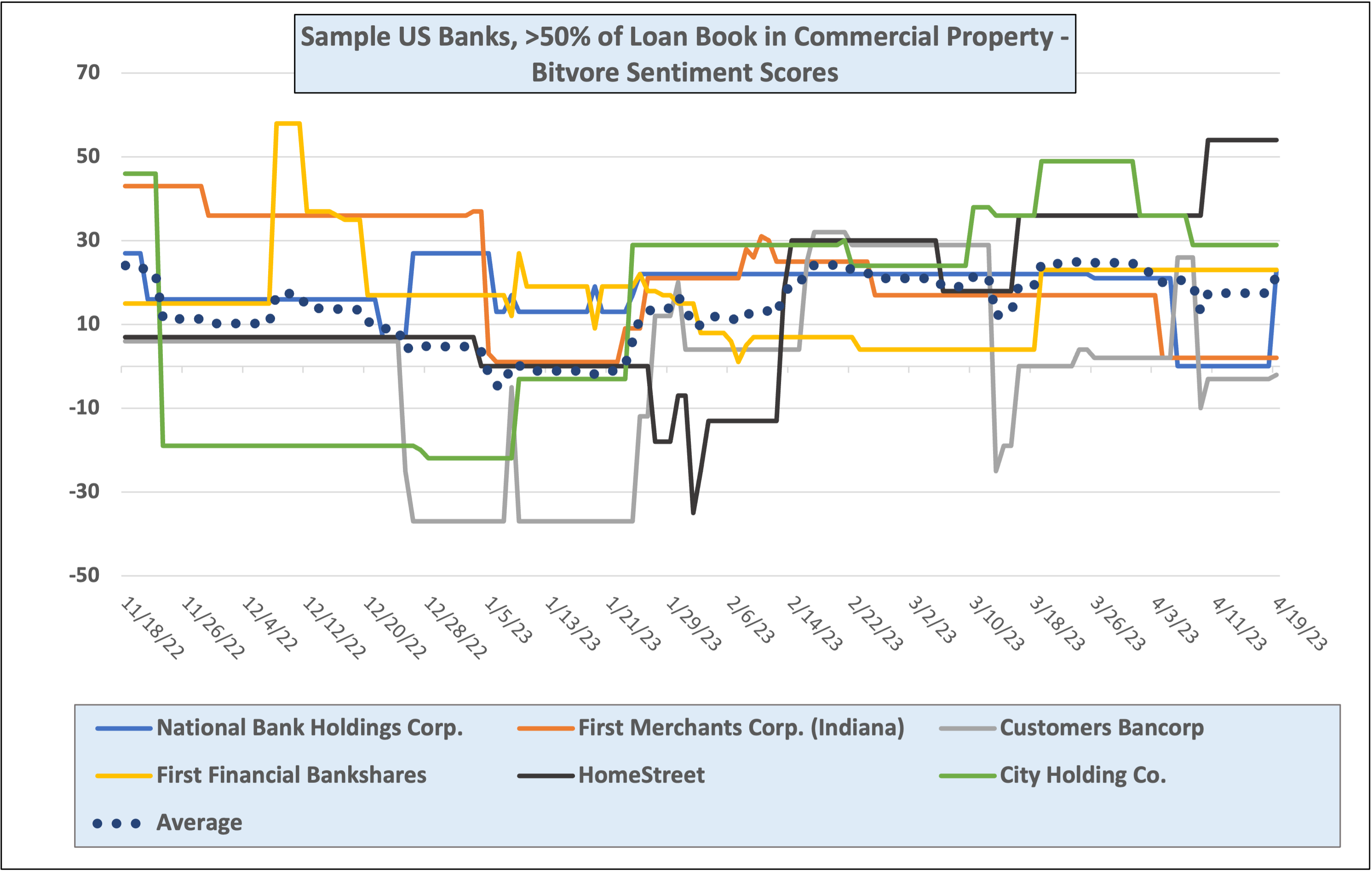

Many of the smaller US banks with large commercial property loan books have experience significant share price volatility. The following graph plots the daily Bitvore Sentiment Scores for a sample of small US Banks whose loans books are estimated to be over 50% exposed to US commercial property. All of their sentiment scores fell towards the end of January but some have since seen a marked rally in their sentiment scores.

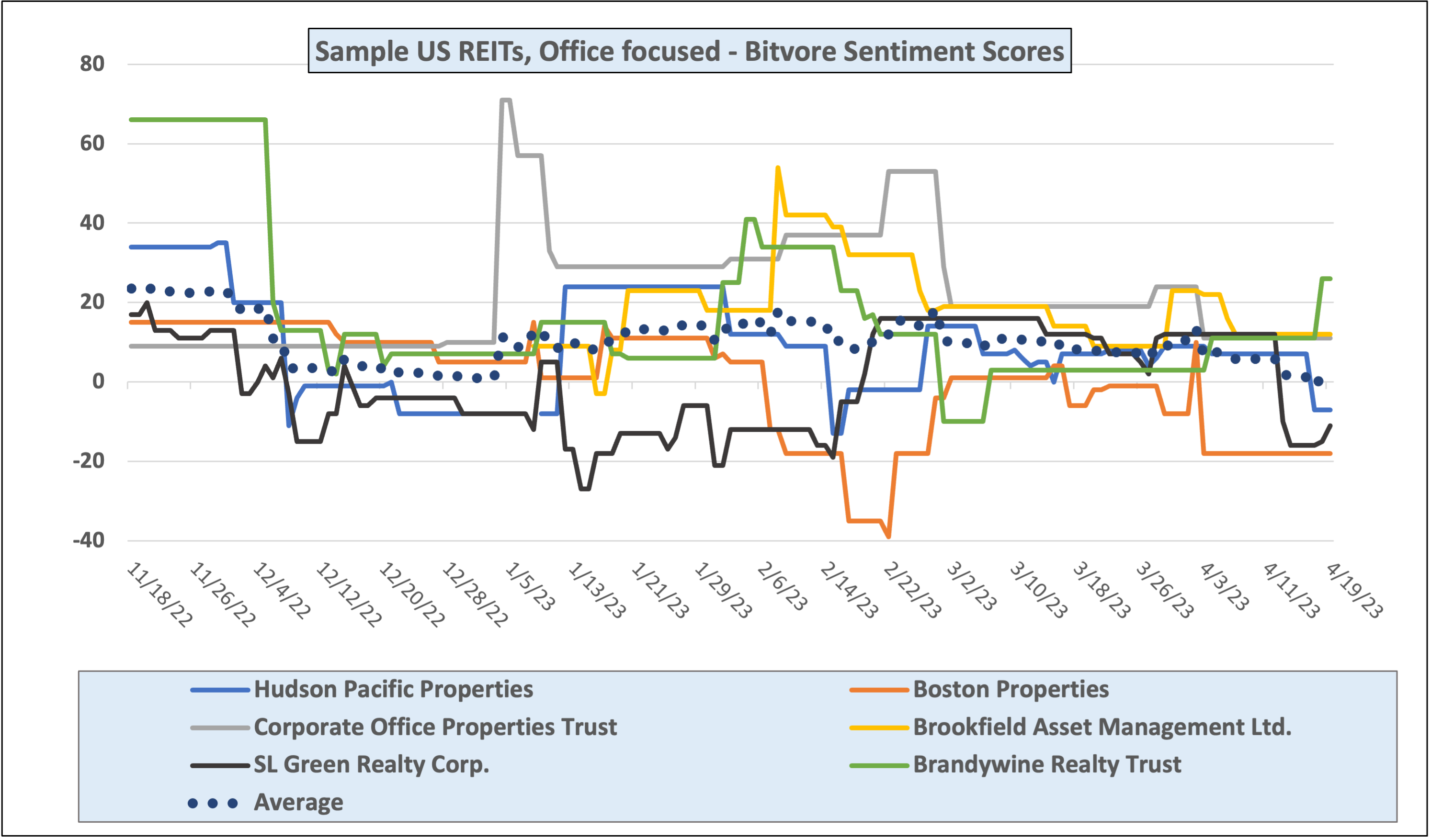

Within publicly traded real estate, the office sector has been one of the most popular shorts for the market since COVID-19 hit. Real estate investment trusts (REITs) with large exposures to office space have been amongst the most volatile over the last few months.

The following graph plots the daily Bitvore Sentiment Scores for a sample of US REITs with office focused portfolios. Again, all of their sentiment scores fell towards the end of January, rallies since in their sentiment scores have generally been muted compared to the banks.

Trusted by more than 70 of the world’s top financial institutions, Bitvore provides the precision intelligence capabilities top firms need to counter risks and drive efficiencies with power of data-driven decision making.

Uncover rich streams of risk and ESG insights from unstructured data that act as the perfect complement to the internal data and insights your firm is already generating. Our artificial intelligence and machine learning powered system provides the ability to see further, respond faster, and capitalize more effectively.

To learn how the Bitvore solutions can help your organization contact info@bitvore.com or visit www.bitvore.com.