Despite the current market volatility, Investment Managers globally continue to successfully launch new ESG focused investment offerings. Europe continues to lead the way, BNP Paribas Asset Management (‘BNPP AM’) European ESG ETF Barometer revealed recently that most investors surveyed expect further expansion of the European ESG ETF market over the next year.

The biannual barometer, conducted for the first time in April this year, monitors how European investors’ sustainable investment outlook and practices are changing over time. It canvasses the views of 250 investment executives at insurers, pension funds, asset managers and wealth managers in France, Germany, Italy, Switzerland and the UK. It assesses their perspectives on the evolving ETF landscape, as well as on ESG integration, thematic opportunities, the regulatory environment and ESG investment risks. Some key findings were that over half of respondents ranked asset managers’ ESG credibility and credentials as a primary consideration in deciding who to allocate to. Also, investors in Switzerland (72%) and the UK (68%) were most interested in a thematic approach to ESG investing, with the circular economy (61%) the most popular theme. The vast majority of respondents (82%) consider thematic ESG ETFs to be active strategies.

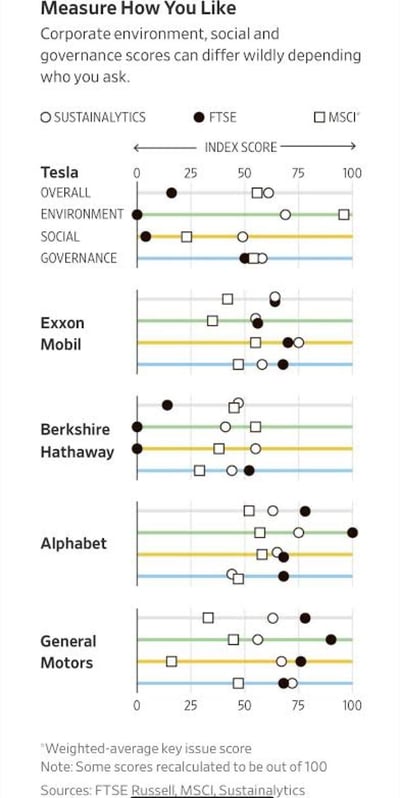

Whether ESG investment products are active or passive all, to a lesser or greater degree, rely on ESG data and ratings to drive their investment and portfolio construction processes. The lack of consistency amongst the ESG data and ratings providers is increasingly and area of focus for investors, academics and regulators. The divergence of ESG ratings can be attributed into three sources; different scope of categories, different measurement of categories; and different weights of categories. Most of the ESG ratings and data providers, make publicly available the overall scores assigned to companies they cover. This increased transparency undoubtedly paves the way for market participants to scrutinize their approach, with the focus being on:

- The differences across firms on what ESG factors are considered material,

- The measurement of ESG factors,

- The weight given to ESG factors, and

- The sources used to carry out the evaluation.

The challenges with ESG data and rating providers were highlighted in feedback to a consultation paper published by the UK’s Financial Conduct Authority published in June 2021. The paper looked into the integration of environmental, sustainable, and governance (ESG) in UK capital markets. Respondents included asset management firms, investment associations, and information services providers. ESG data and rating providers were an area of concern for the respondents. The FCA stated: “A significant majority of the 40 respondents agreed with the challenges and potential harms we identified”.

In addition to the potential harms identified, some respondents commented on the quality of ratings. Some were concerned by the backward looking nature of many ESG ratings and by the low frequency of (annual) sustainability disclosures on which most ratings rely. The FCA also said that some respondents questioned “the depth of knowledge” of ESG rating providers’ analysts. This is because some analysts cover a significant number of rated entities for cost efficiency reasons.

Another issue the respondents raised is potential “market power issues” arising from market concentration due to rated entities’ deprioritising data requests from smaller rating providers. Some asset managers also highlighted the high costs, partly driven by asset owners’ requests to use specific providers and by product bundling. A majority of respondents was also supportive of the regulator either encouraging providers to adopt a voluntary Best Practice Code.

Increasingly investors and product providers are building out their own ESG analysis capabilities and processes. Trusted by more than 70 of the world’s top financial institutions, Bitvore provides the precision intelligence capabilities top firms need to counter risks and explore opportunities with power of data-driven decision making.

Uncover rich streams of ESG and risk insights from unstructured data that act as the perfect complement to the internal data and insights your firm is already generating. Our artificial intelligence and machine learning powered system provides the ability to see further, respond faster, and capitalize more effectively.

Get in touch today to learn how the Bitvore family of products can help your organization at www.bitvore.com.