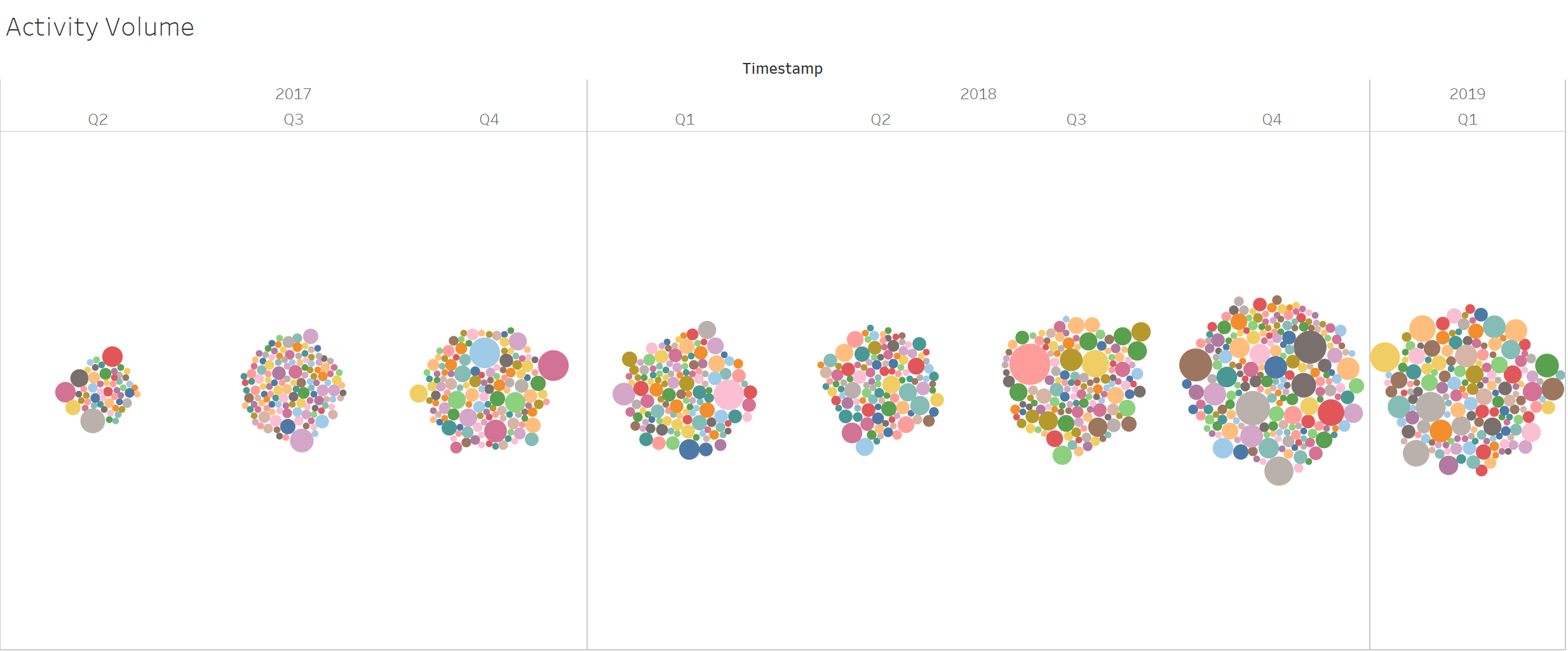

The above shows the M&A activity by volume for each year: 2017, 2018, and 2019 to date. Each colored bubble represents a uniquely identified company in the precision news feed. The largest bubble in 2017 represents Thoma Bravo LLC’s multiple acquisitions. In 2018, the largest cybersecurity acquirer was Cisco. 2019 thus far, is a toss up between Carbonite, Symantec, Zix Corp., and a few others. With Q1’2019 about to end, the total volume of news about cybersecurity M&A is about to surpass the total amount for 2017 and Q4’2018.

Breaking it down a little further, we wanted to see how the market was reacting to these announcements, so we grouped each record by month. Each individual company identified in that month is grouped into the same circle. In the graphic below, the size of dots represent the sum of the M&A activity by any individual company that had news within the monthly period. The larger the dot, the more activity occurred. Some dots include multiple targets, as some of the companies were very acquisitive. We also sorted the dots according to first mention in the month of the organization. The time period covers Q1-Q4 for 2018 and most of Q1 2019.

.png?width=4894&name=Coverage%20%26%20Sentiment%20(2018-2019).png)

Red dots represent a negative sentiment, and green dots represent positive. October 2018 had a string of negative merger & acquisition stories for Facebook Inc., Amazon Web Services Inc., The Information Management Group (IMG), Healthcare Appraisers Inc., and Context Relevant Inc. November included negative stories for Marriott, Blackberry Ltd., Cylance, and Fifth Dimension. December markets had negative reactions to Sprint, Sempra Energy, Echo Partners LLC., Huawei Technologies, and Huntington Ingalls. Despite a few negative reactions, most mergers & acquisitions stories were positive, and there were a lot of them. 2019 has had a few negative spots involving Radware and the continued coverage of Marriott’s Starwood acquisition, as it relates to their data breach. February shows negative stories about Carbonite, Sprint, Webroot Inc., and Palo Alto Networks.

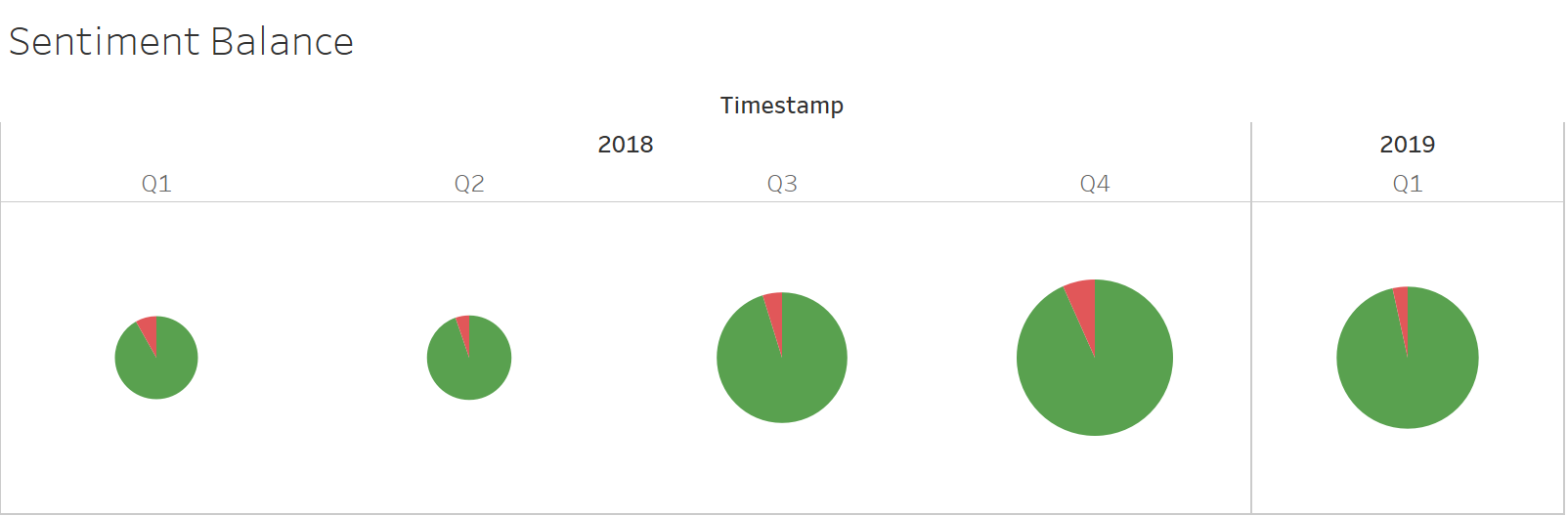

Below pie charts over the time period give a better perspective. Despite some negative stories, acquisitions in the cybersecurity space have been overwhelmingly positive.

Our data does in fact confirm that 2018 was a banner year for cybersecurity M&A activity. Further, Q1’2019 seems to be on track to match or exceed the amount of activity in Q4’2018. However the real question is, will the “frothy” cybersecurity M&A activity continue throughout the rest of 2019, or will it fizzle out?

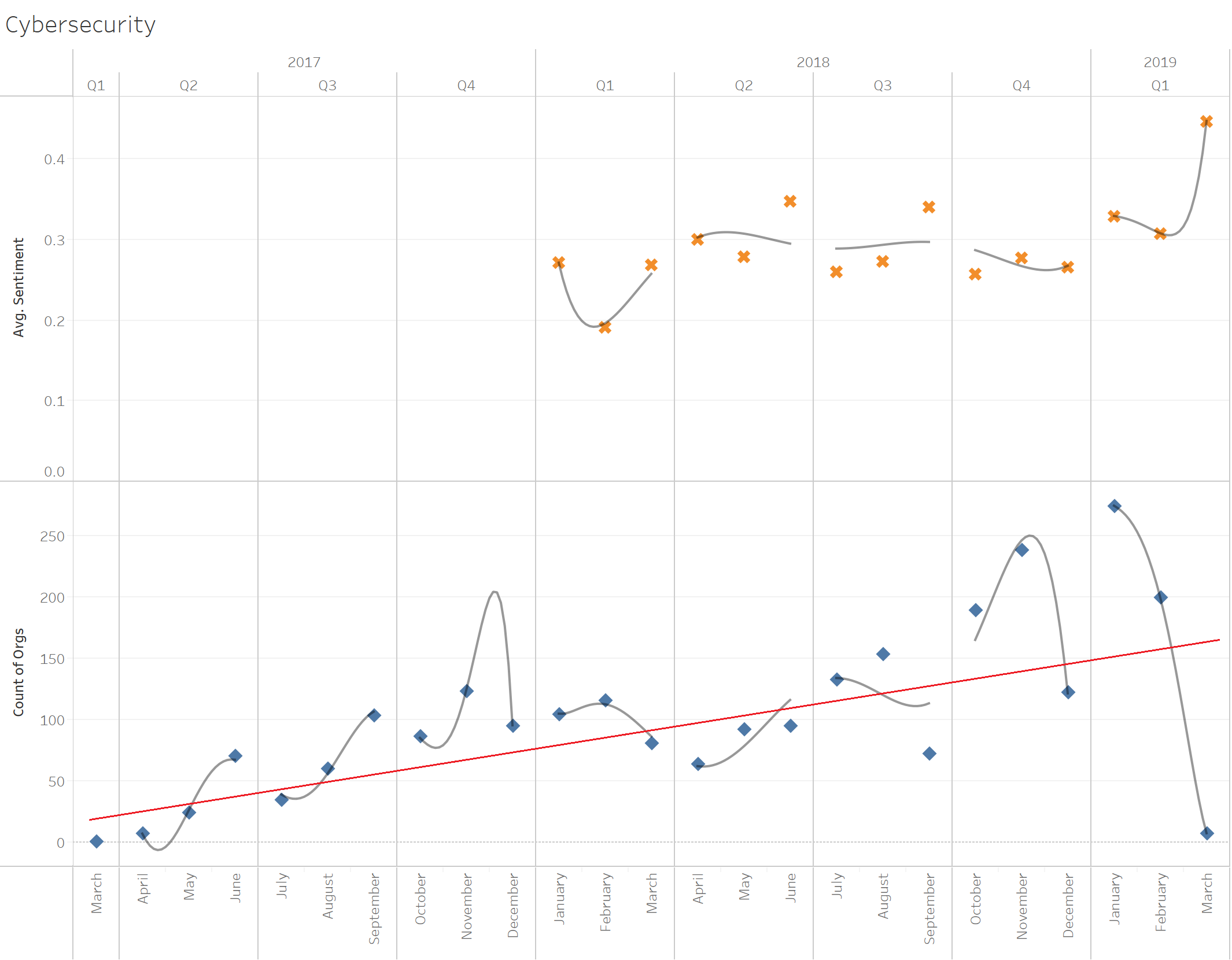

Below, we plotted one last graph to find an answer. The top graph shows 2018-2019 average sentiment trends across all mergers and acquisitions for each month. The bottom graph shows the number of unique companies per month involved in all cybersecurity M&A activity. To see if there were any longer term volume trends, we extended the numbers a few quarters back into 2017.

It appears sentiment has generally been trending up, though slowly. Likewise, the amount of company activity has a long term upward trend with spikes in November 2017, November 2018, and January 2019. Sentiment in March 2019 for cybersecurity acquisition news has never been higher in the history of our data. Although the quarter isn’t closed yet, the amount of activity in March has dropped off significantly. This divergence between the two trends represents a change in the dynamics of the activity. No matter how positive the market sentiment is, without more activity moving the graph back towards the long-term trend line, there’s a possibility the cybersecurity market might be reaching the end of current rollups. With a couple weeks remaining in Q1, it will be interesting to carefully track any other M&A announcements from now until the end of March. If the volume of activity doesn’t normalize by April, there’s a good chance we might be looking at the end of the trend: the new year starting out with a bang, but ending with a whimper.

Want to learn more about how signal-driven intelligence provides triggers for sales, asset managers, and others to facilitate better and faster decisions? Get the full list of Bitvore's business signals and their descriptions below.